Stop Loss Guide

Protect your positions with stop-loss orders. Automatically sell when prices drop to limit your losses.

Before You Start

- What is a stop loss? An order that automatically sells your position if the price drops to a specified level.

- Why use it? To limit potential losses without constantly monitoring the market.

- Monitoring: PolyBot continuously monitors prices and executes your stop loss when triggered.

Stop losses are a key risk management tool. They help you define your maximum acceptable loss on any position before you enter the trade.

How Stop Loss Works

- You set a trigger price or trigger percentage on an open position.

- PolyBot monitors the market price continuously.

- When the price drops to your trigger level, the stop loss activates.

- Your shares are sold automatically (at market or limit price, depending on your settings).

- You receive a notification with the execution details.

Trigger Types

Choose how to define when your stop loss triggers:

Fixed Price Trigger

Set a specific price in cents where you want to sell.

Example: You bought at 50¢. Set stop loss at 40¢.

- If price drops to 40¢ or below → Stop loss triggers.

Best for: When you know the exact price level you want to exit at.

Percentage Trigger

Set a percentage drop from your entry price.

Example: You bought at 50¢. Set stop loss at -20%.

- Trigger price = 50¢ × (1 - 0.20) = 40¢

- If price drops to 40¢ or below → Stop loss triggers.

Best for: When you want consistent risk management across different entry prices.

Execution Modes

Choose how your stop loss executes when triggered:

| Mode | How It Works | Pros | Cons |

|---|---|---|---|

| ⚡ Stop-Loss (Market) | Sells immediately at current market price | Fast, guaranteed execution | Price may vary (slippage) |

| 🎯 Stop-Limit | Places limit order at trigger price | Price guaranteed if filled | May not fill if price gaps |

When to Use Each Mode

Use Market Mode when:

- You prioritize getting out of the position.

- The market has good liquidity.

- You accept some price uncertainty for guaranteed execution.

Use Limit Mode when:

- You want to ensure a specific exit price.

- You're okay with the risk of not filling if price moves quickly.

- You're protecting a large position.

Creating a Stop Loss

Step 1: Open Stop Loss Menu

- Command:

/stoploss - Or go to Main Menu → 📈 Orders → 🛡️ Stop Loss

Step 2: Select a Position

- Tap ➕ New Stop Loss.

- Choose from your open positions.

- Shows available shares (excluding shares already covered by other stop losses).

Step 3: Choose Trigger Type

- 💲 Fixed Price — Enter a specific price in cents.

- 📊 Percentage — Enter a percentage drop from entry.

Step 4: Set the Trigger

For Fixed Price:

- Enter the price in cents (e.g.,

40for 40¢). - Must be below the current price.

For Percentage:

- Enter the percentage (e.g.,

20for 20%). - Shows the calculated trigger price.

Step 5: Select Quantity

Choose how many shares to protect:

| Option | Description |

|---|---|

| 25% | Protect a quarter of your position |

| 50% | Protect half your position |

| 75% | Protect most of your position |

| 100% | Protect your entire position |

| Custom | Enter a specific number of shares |

You can create multiple stop losses at different levels. For example, sell 50% at -15% and remaining 50% at -25%.

Step 6: Choose Execution Mode

- ⚡ Stop-Loss — Market execution (default)

- 🎯 Stop-Limit — Limit execution at trigger price

Step 7: Confirm

Review your stop loss details:

- Shares protected

- Trigger price

- Execution mode

- Estimated proceeds (approximate)

Tap ✅ Confirm to activate.

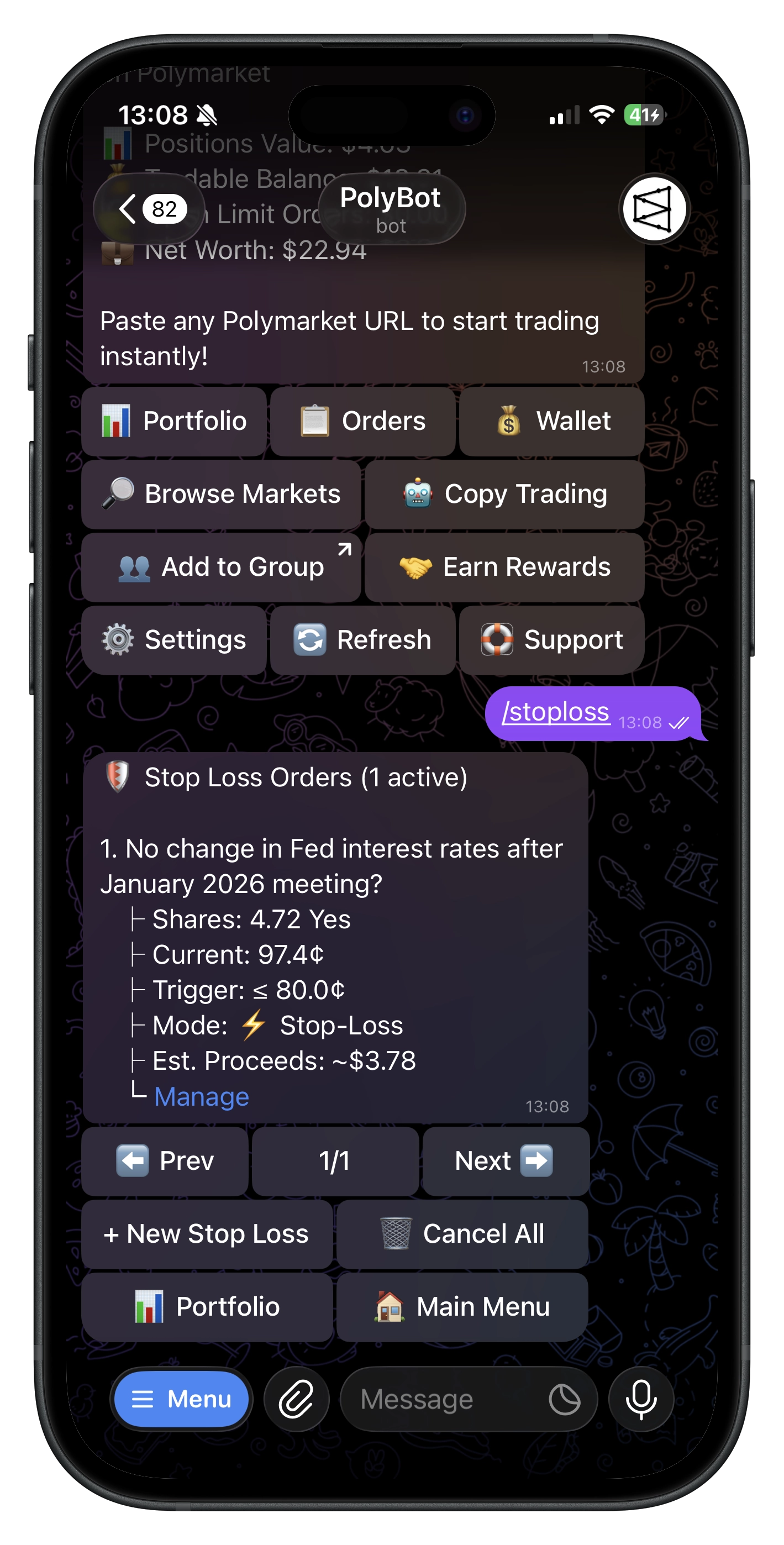

Managing Stop Losses

Viewing Active Stop Losses

- Command:

/stoploss - See all active stop losses with:

- Market and outcome

- Current price vs trigger price

- Shares protected

- Execution mode

- Estimated proceeds

Editing a Stop Loss

- Open the stop loss.

- Tap ✏️ Edit.

- You can change:

- 🎯 Trigger — New trigger price or percentage

- ⚖️ Quantity — Number of shares

Canceling a Stop Loss

- Open the stop loss.

- Tap 🗑️ Delete.

- Confirm cancellation.

Cancel All Stop Losses

- Go to the stop loss list.

- Tap 🗑️ Cancel All.

- Confirm to remove all active stop losses.

Stop Loss Lifecycle

Your stop loss goes through these stages:

ACTIVE → TRIGGERED → EXECUTING → FILLED

↘ FAILED (if execution fails)

| Status | Meaning |

|---|---|

| Active | Monitoring price, waiting to trigger |

| Triggered | Price hit trigger level, preparing to sell |

| Executing | Sell order being placed |

| Filled | Successfully sold, funds in wallet |

| Failed | Execution failed after retries |

| Canceled | You or the system canceled it |

Auto-Cancellation

PolyBot automatically cancels stop losses in certain situations:

| Reason | What Happened |

|---|---|

| Insufficient Shares | You sold shares elsewhere, not enough left for stop loss |

| Position Closed | Your position no longer exists |

| Market Resolved | The market has settled |

When auto-canceled, you receive a notification explaining why.

Notifications

When Stop Loss Executes

You receive a message showing:

- 🔔 Stop Loss Executed!

- Market and outcome

- Trigger price

- Shares sold

- Average execution price

- Total proceeds

When Stop Loss Auto-Cancels

You receive a message showing:

- 🔔 Stop Loss Auto-Canceled

- Reason for cancellation

- Required vs available shares

Price Calculations

Fixed Price

You enter the exact price. No calculation needed.

Constraints:

- Must be between 0.1¢ and 99.9¢.

- Must be below the current market price.

Percentage from Entry

Trigger Price = Entry Price × (1 - Percentage / 100)

Examples (Entry at 60¢):

| Percentage | Calculation | Trigger Price |

|---|---|---|

| -10% | 60 × 0.90 | 54¢ |

| -20% | 60 × 0.80 | 48¢ |

| -30% | 60 × 0.70 | 42¢ |

Reserved Shares

When you create a stop loss, those shares are "reserved":

- Reserved shares cannot be used for other stop losses.

- Available shares = Total shares - Reserved shares

- If you sell shares manually, stop losses may be auto-canceled if not enough remain.

Example:

- You hold 100 shares.

- Create stop loss for 60 shares → 60 reserved.

- Available for another stop loss: 40 shares.

Commands

| Command | What It Does |

|---|---|

/stoploss | Open stop loss menu |

Example Strategies

Simple Protection

Protect your entire position with one stop loss:

Position: 100 shares at 50¢

Stop Loss: -20% (trigger at 40¢) → Sell 100%

Scaled Exit

Multiple stop losses at different levels:

Position: 100 shares at 50¢

Stop Loss 1: -10% (45¢) → Sell 50 shares

Stop Loss 2: -25% (37.5¢) → Sell 50 shares

Tight Risk Management

For high-conviction trades with strict limits:

Position: 100 shares at 70¢

Stop Loss: -7% (65¢) → Sell 100%

Stop Loss vs Presets

| Feature | Stop Loss | Presets |

|---|---|---|

| Creation | Manual per position | Template-based |

| Take Profit | ❌ No | ✅ Yes |

| Stop Loss | ✅ Yes | ✅ Yes |

| Auto-Apply | ❌ No | ✅ Yes |

| Edit Individual | ✅ Yes | Limited |

Use Stop Loss when:

- You want standalone protective orders.

- You need fine-grained control per position.

- You want to add protection to existing positions.

Use Presets when:

- You want combined take-profit and stop-loss.

- You want automatic application on every buy.

- You prefer template-based strategies.

Troubleshooting

- Cannot create stop loss: Ensure you have an open position with available (unreserved) shares.

- Trigger must be below current price: Stop losses only trigger on price drops.

- Stop loss not triggering: The market price must reach your trigger level. Check current prices.

- Auto-canceled unexpectedly: You may have sold shares elsewhere. Check the notification for details.

- Failed after triggering: The sell order couldn't execute. Check market liquidity.

- Limit order not filling: In Stop-Limit mode, if price gaps past your trigger, the limit order may not fill.

Related Guides

- Presets Guide — Combined exit strategies with take-profit

- Trading Guide — Manual trading and selling

- Portfolio Guide — Managing your positions