Trading Guide

This guide explains how to trade on Polymarket using PolyBot in Telegram: paste‑to‑trade, market buys, selling, limit orders, and order management.

Before You Start

- Network: Polygon (PoS). Trading balance is USDC.e.

- Gas: Sponsored by PolyBot's relayer — you do not need MATIC.

- Deposit: Send USDC or USDC.e on Polygon to your wallet (see

/wallet). USDC auto‑converts to USDC.e in the background.

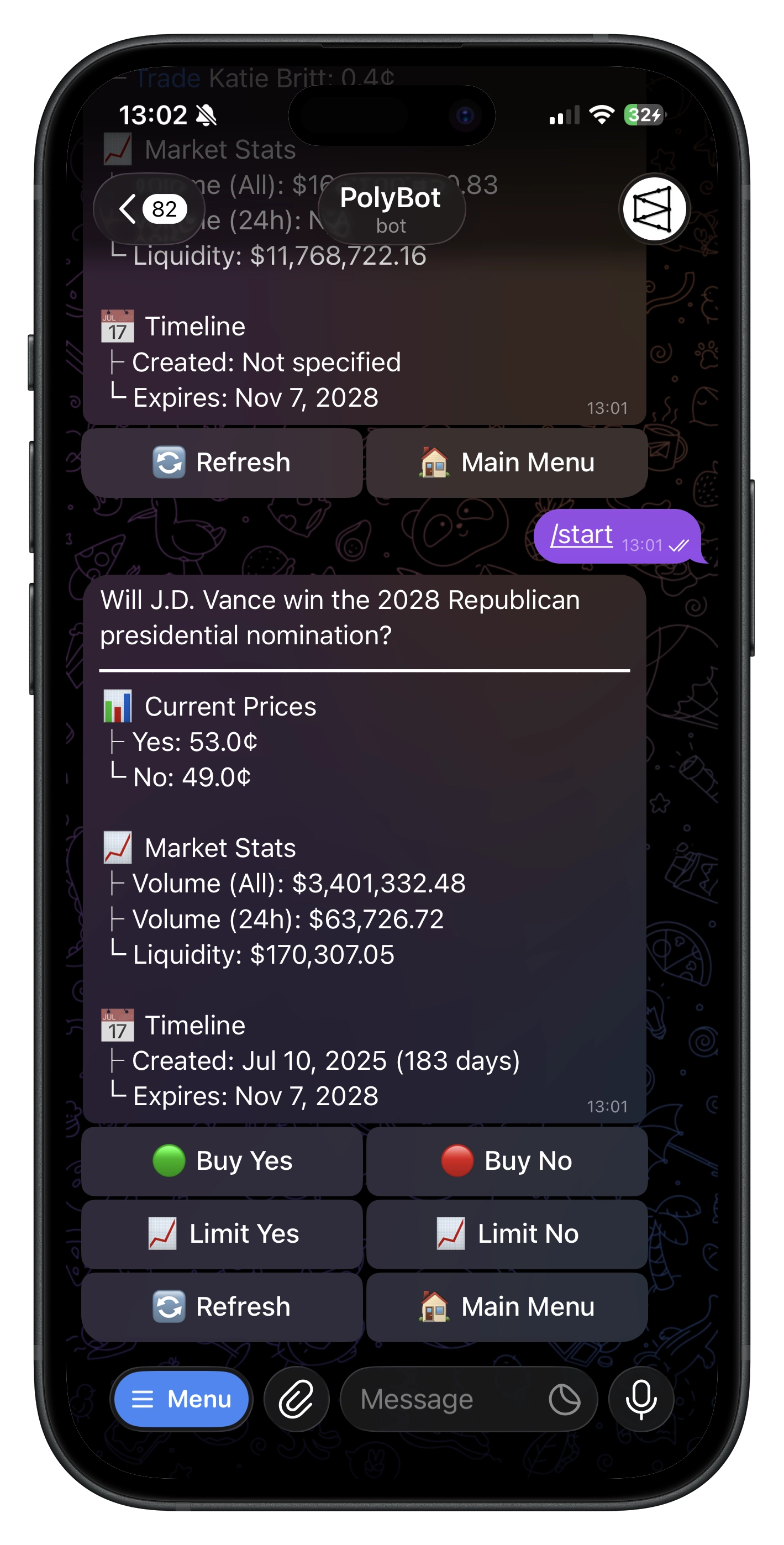

Paste‑to‑Trade

- Paste a Polymarket URL (e.g.,

https://polymarket.com/event/...) directly in chat. - PolyBot opens the market view with live prices and stats.

- Use the inline buttons (binary markets):

✅ Buy YES,❌ Buy NO📈 Limit YES,📈 Limit NO🔄 Refresh,🏠 Back to Home

- For categorical markets, PolyBot lists outcomes with trade deep‑links back into the bot and a view link to Polymarket, plus

🔄 Refresh/🏠 Back to Home.

Prices shown prefer last trade when available, else mid bid/ask if spread is reasonable, else cached price. Use 🔄 Refresh to update.

Market Orders (Buy)

- On a binary market, tap

✅ Buy YESor❌ Buy NO. - Choose a quick‑buy amount (defaults $10 / $25 / $50) or enter a custom amount.

- Review the confirmation:

- Market and outcome

- Amount (net after fee)

- Estimated shares (VWAP‑based when order book is available)

- Price per share (¢)

- Tap

✅ Confirm Orderto execute.

PolyBot submits a market order via the Polymarket CLOB. On success, you'll see shares and average price; your portfolio updates shortly.

Tips

- Minimum size for market buys is about $1.

- If you’re asked to retry, approvals or Safe deployment may be finishing — try again in a few seconds.

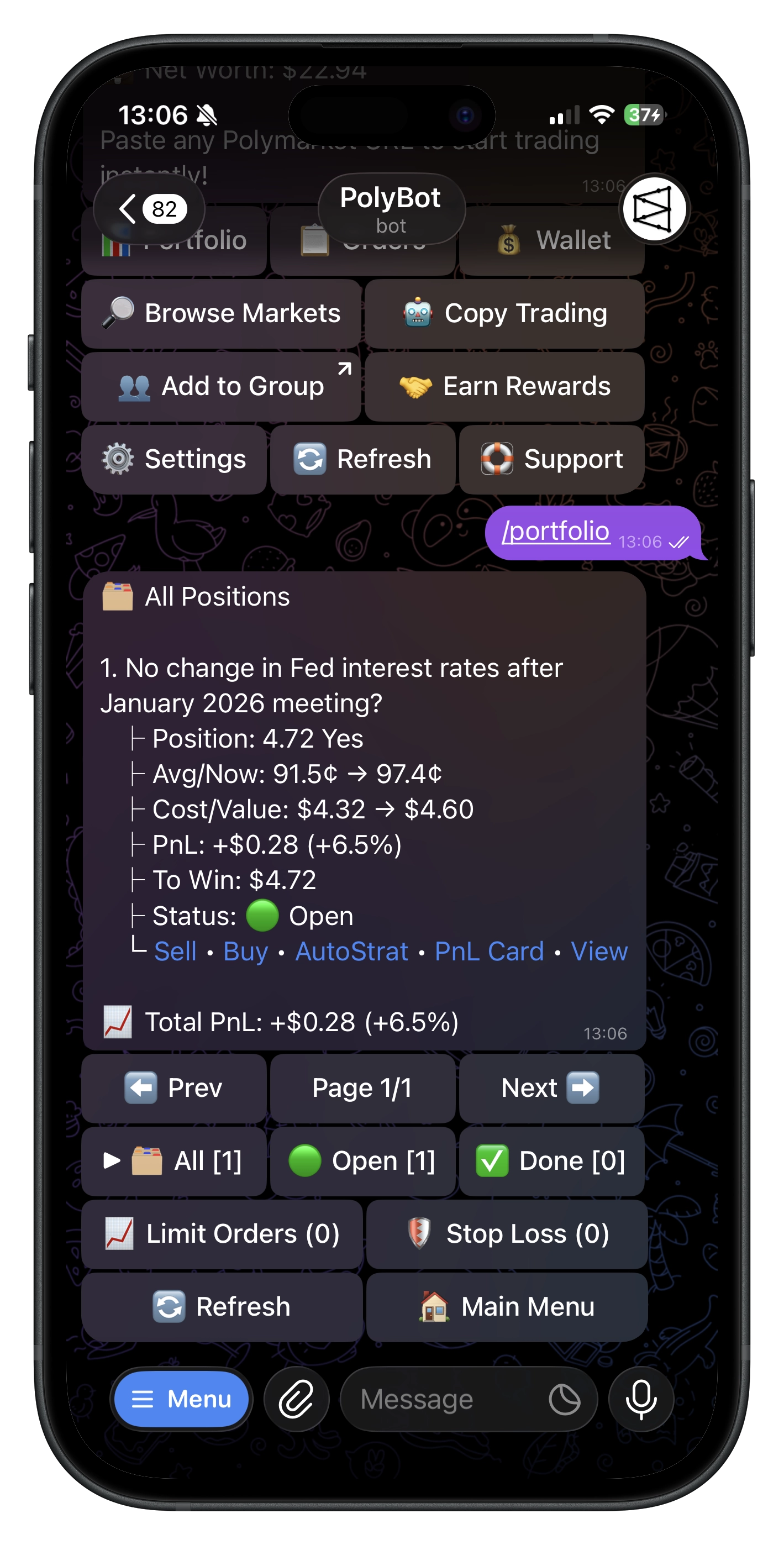

Selling at Market

- Open

/portfolio(or tap 📊 Portfolio on the Main Menu). - Select a position → choose Sell.

- Pick 25/50/75/100% or enter a custom number of shares.

- Confirm the sell. Success shows shares sold, price, and proceeds.

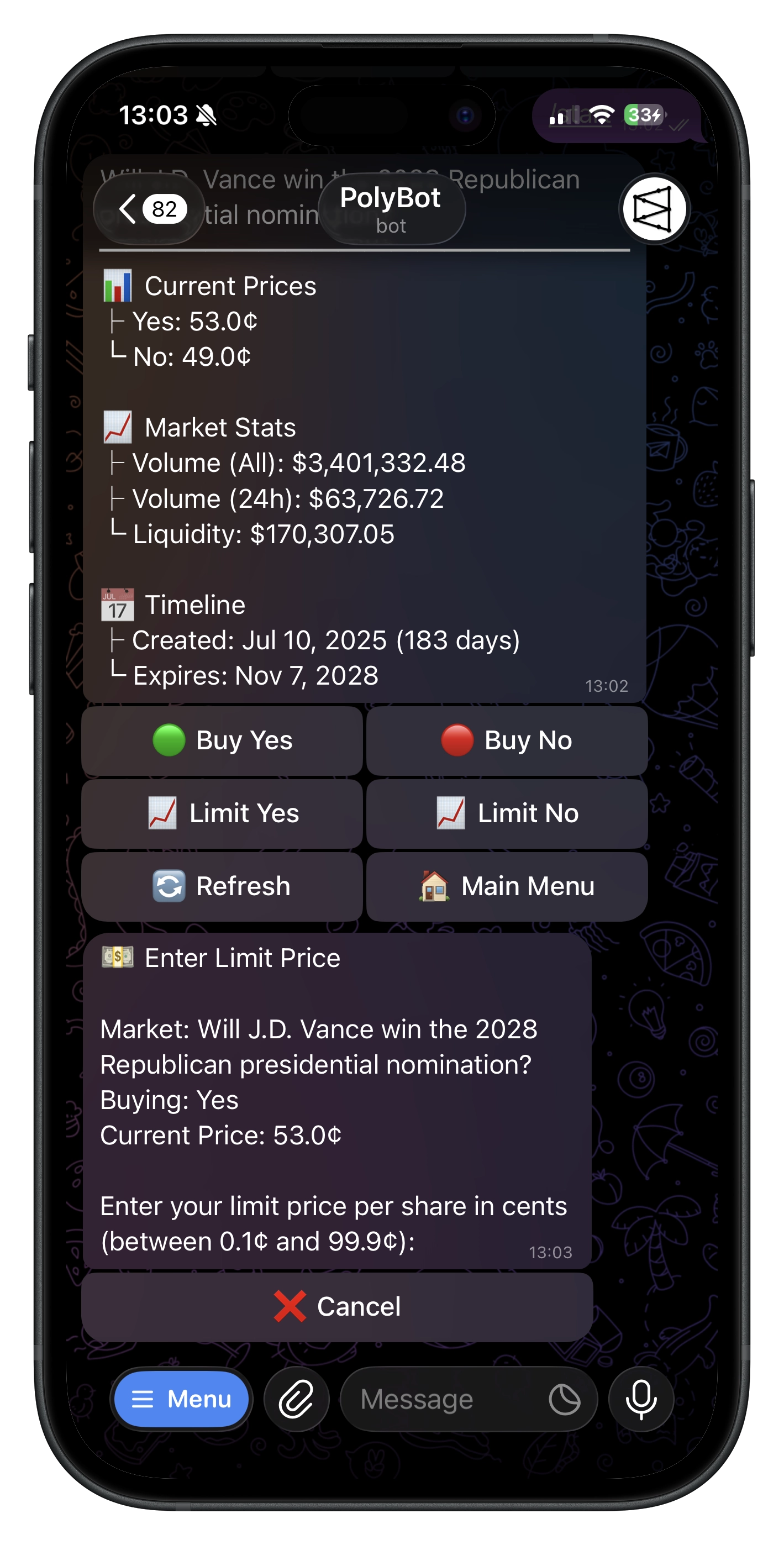

Limit Orders

Limit Buy (from market)

- On a binary market, tap

📈 Limit YESor📈 Limit NO. - Enter a limit price in cents (e.g.,

75→ $0.75). - Enter number of shares.

- Minimum: 5 shares (after fee reservation).

- Confirm details:

- Outcome, limit price vs current price

- Shares and total cost

- Warning if your price would execute immediately at market

- Confirm to place the GTC order.

Limit Sell (from portfolio)

- In

/portfolio, chooseLimit Sellon a position. - Enter the limit price (¢) → enter shares (≥ 5).

- Confirmation shows:

- Shares, limit price, total value

- Fee (bps) and net proceeds

- Confirm to place the GTC order.

Managing Orders

- From Main Menu, open

📈 Limit Orders. - See each order’s market, outcome, side, limit price (¢), current price (¢), size, value, and fill status.

- Cancel: Use the

Canceldeep‑link; PolyBot submits the cancel to the CLOB. - Use

🔄 Refreshto update the list.

Prices, Estimates & Slippage

- Market views pick the best available indicator (last trade > sane mid) and clamp values to sensible ranges.

- Confirmations show net spend and estimated shares to set expectations before execution.

Quick‑Buy Amounts

- Defaults are $10 / $25 / $50.

- Customize in

⚙️ Settings(edit Left/Center/Right).

Negative‑Risk Markets

- PolyBot supports standard and negative‑risk markets seamlessly.

- Wallets created now are pre‑approved for the required contracts; older wallets may auto‑approve on demand (you might see a brief retry prompt once).

Troubleshooting

- “Please try again in a few seconds”: Approvals or Safe deployment are finishing; retry shortly.

- Deposit not visible: Ensure Polygon network, allow 1–3 minutes for confirmations/auto‑swap, then refresh.

- Canceled but still visible: Use

🔄 Refreshon the Limit Orders screen.

Useful Commands

/start— Begin or open deep links/home— Main Menu/wallet— Wallet (deposit, withdraw)/portfolio— Open positions/help— Help & FAQs